Some of us are fated to become entrepreneurs—from building a demand-driven Dunkaroos supply chain on the playground to constructing our first driveway lemonade stand—we’re fearless and possess a relentless fire that fuels our determination.

However, for most of us, starting a business is a daunting and overwhelming endeavor. There are too many wildcards and unknowns. But if you’ve been contemplating becoming an entrepreneur, don’t let your fears overshadow the benefits that go along with it.

Below are several resource sections for your entrepreneurial journey:

- The wrong reasons to start your own business

- Benefits of starting your own business

- How to conduct market research for your new business

- The perfect business plan

- What’s the best business structure?

- Choosing your business location

- Finding the funds

Wrong Reasons to Start Your Own Business

Let’s start with this because if you’re thinking of starting your business for any of these reasons, read no further.

One day, you’re sitting in your cubicle, crunching numbers, booking executive travel, or whatever it is that you do. Then you get a rude email from the boss about something you had no control over, and you have a Eureka moment.

Enough of this. No more answering to that jerk. I’m going to start my own business. I’ll decide what that is later.

You close whatever you’re working on, fire up Word, and start on your resignation letter—even though entrepreneurship had never crossed your mind until this moment.

Doesn’t make much sense, does it?

There are a lot of good reasons to start a business, like having a unique idea that will deliver value to customers and produce a sustainable income for you. There are also a lot of bad ones, like getting away from an obnoxious boss.

We’re not trying to discourage you, but running a business isn’t for everyone, which is one of the reasons why 20% of small businesses fail during their first year. If you’re thinking about building an empire for reasons like those below, hold that thought- maybe indefinitely.

You Want to Be Your Own Boss

Technically, there’s nothing wrong with this goal. Just be careful not to equate it with getting to do whatever you want.

When you’re an entrepreneur, you may not have a boss as such, but you answer to a LOT of people, namely customers, vendors, and employees. If you put their needs second to your own all the time, you won’t succeed and before long, you won’t have a business.

Your Job Sucks

We’ve all had That Job. The one where the boss is oblivious or a micromanager, coworkers apply a wrecking ball to reputations, and there’s a disconnect between the hours you put in and the total on your paycheck.

According to a 2019 report by SHRM, one in five Americans has left a job in the last five years due to a toxic work culture. While some may have decided to act on a long-held dream of entrepreneurship, the majority likely found jobs they liked better. If you’ve never thought of running your own company until your boss got on your last nerve, you’re better off doing the same. (P.S. if you think your boss was bad, try dealing with a difficult customer!)

You Want to Get Rich

Too many late-night infomercials may have convinced you that if you get into such-and-such an industry, you’ll be independently wealthy before the year is out.

If you buy a winning lotto ticket during that time, it’s possible. Otherwise, you’re looking at years of hard work developing a business strategy, marketing it, and getting lots of no’s before you get a yes. Unless you love and believe in what you do, you’ll give up before you make enough to pay the electric bill.

You Want A Four-Hour Work Week

We’re not dissing Tim Ferris’s bestseller, but we are trying to make a point: if you want to start a business so you can work fewer hours, you’ve chosen the wrong occupation.

In the beginning, at least, entrepreneurs frequently work over 60 hours a week. You’ve got strategies to test, product to order or develop, and marketing campaigns to put together. Unlike your employee days, you can’t clock out at 5:00 p.m. and let a boss worry about stuff like keeping the business profitable. You ARE the boss. If you find this thought uncomfortable, stay employed.

You Want A Better Work-Life Balance

Being master of your own ship means that you can get up whenever you want or go away for weeks at a time, right?

Wrong. You may be your own boss, but you can’t put the business on hold so you can sleep until noon or enjoy a spiritual quest in the Andes. Customers won’t stand for it, especially if you have a storefront, and will quickly find a competitor who puts them first.

This is not to say that you can’t enjoy the occasional morning off or take a vacation. They just have to be scheduled at a time when someone can cover for you or, in the case of an online business, you have sufficient lead time to let customers know you’ll be absent.

You Want to Be Famous

Zuckerberg. Gates. Musk. (Insert your name here.)

You may be inspired by how these names dominate the media and wouldn’t mind if yours made the A-list too. What better way to do it than to start a business that becomes a household name?

If this happens, great! But it’s the wrong reason to become an entrepreneur. The most successful startups are those owned by people who work hard, know what their customers want and how to deliver real value. If you’re looking for a celebrity, there are quicker (albeit more questionable) ways to go viral.

Your Best Friend Wants to Start a Business with You

Your best friend has an idea that’s sure to take off. He’s always been creative, but he needs a practical partner (you) to help translate his vision into customers and cash.

Unless your friend has a track history of spinning his dreams into gold, stay practical, even if his proposal sounds good. Starting a business is hard work, and unless you’re both 100% committed and realistic about the venture, it’s not likely to work.

So, do You Really Want to do This?

Business owners become successful when they start their companies for the right reason (delivering value to customers), love what they do, and are willing to put in the time and effort to turn their concepts into a well-paying reality.

This is where you need to be honest with yourself: if all you want to do is get away from a bad boss, maybe you should change companies, not careers.

The benefits of starting your own business

Caw, caw! You’re a Free bird

The academic International Entrepreneurship and Management Journal published a global survey that focused on the motivations of entrepreneurs in the early stages of their start-up. Guess what was the leading motivator of entrepreneurs to start their own business? Independence. It’s the prime motive for becoming self-employed.

- Twenty-five countries were included in the study and 38 percent of early-stage business owners mentioned independence as an incentive to take the plunge into entrepreneurship.

- Freedom was a motive for 35 percent of entrepreneurs in the US and the United Kingdom.

- A whopping 57 percent cited independence as their motivator in Australia and Japan.

We all desire freedom. Who doesn’t want more flexible work hours or the ability to set their own deadlines?

You get to call all the shots and make the rules. Want to sell in person, inbound, outbound, online, or all of the above? It’s up to you. You create your own environment and culture in your organization. You’re the head honcho!

Note: you may eventually have more spare time to enjoy with your family and friends, but this should be considered a long-term goal. Realistically, expect to have much less time until your business is well-established, and you’re comfortable enough to pass the majority of tasks and responsibilities to your trusted employees.

A sense of self-pride

Did you know that pride is the father of all sins? It is said to be the devil’s most prominent trait and most severe of the seven deadly sins. Well, we disagree.

While remaining humble and grounded is still important, a little bit of pride can be extremely beneficial in reinforcing self-worth and boosting self-esteem—allowing us to acknowledge our achievements and take credit when credit is due (like launching a prosperous business).

There’s a serious amount of time, resources, and effort that go into building a business and you’ll pay for it in sweat, tears, and blood. But that’s alright because entrepreneurs don’t shy away from hard work or give up easily. We aspire to push the boundaries.

Your new business is all yours. You own it. Your name is literally on the registration. Anything your company does, whether it be an amazing accomplishment or a PR nightmare, it comes back to you. Take pleasure in what you do and own your success; be a boss.

Why should you care? Well, your business will most likely fail if you don’t. Also, Psychological Science in the Public Interest found that self-esteem is an extremely powerful thing. I know that this isn’t groundbreaking, but it’s worth mentioning that self-esteem is positively associated with:

- Higher confidence in group settings

- More persistence (think sales)

- Greater happiness and satisfaction

Note: There are no participation awards or trophies when it comes to running your own business. Just saying.

Ownership = meaning and commitment

You’ll also discover a great source of meaning and commitment in your life by building a business that you have so much pride in.

Meaning differs from pride, which we discussed above, in that pride is quite external, while meaning forms from an overarching sense of internal purpose.

Starting a business puts you on a long and arduous path and, if you’re committed, then it immediately creates purpose.

Commitment further reinforces that sense of purpose, and ownership boosts commitment even more-so. There’s a famous experiment where researchers divided test subjects into two sets for a lottery. People in one set were preassigned a random number for the lottery, while the other set of people got to choose their own number.

The research team then asked to repurchase the lottery tickets from both groups. Here’s the fun part. The subjects who had chosen their own number asked for, on average, five times more money for their ticket, even though their number choice gave them no better odds at winning the lottery; this is an excellent example of the power of ownership.

Those of us who own a business are committed to it, and this inevitably reinforces our sense of purpose.

Bonus: life with purpose can improve your health.

How to Conduct Market Research for your new business

You’ve got a great idea for a business. No, make that an AMAZING idea. You’re so confident of success that you’re willing to invest your savings and max out every credit line you’re eligible for in order to get it off the ground.

Not so fast.

We’re not trying to kill your enthusiasm -inspiration has turned many a startup into a household name. We just want you to curb it a little until you’ve had the chance to do a little market research. Companies are like kids- the most successful ones do their homework.

Market Research: What It Is and Why It Matters

Market research is the process of collecting, evaluating, and interpreting information about the market you intend to serve, so that you can better develop a product or service that meets its needs. The goal is to understand everything you need to know about:

- Your ideal customer

- The industry you’ll be working in

- Your competitors

One of the biggest reasons why businesses fail is that they don’t take this critical step. For many entrepreneurs, there’s pride involved: they’re positive that their concept is perfect just the way it is and aren’t interested in any pessimistic negative feedback that could delay the launch- even if that feedback could double their sales.

With other business owners, the issue is money. They have a shoestring budget and don’t want to spend any of their scarce funds on research that will only tell them what they knew all along: their products or services will make them millions.

Starting a new business is always an act of faith to some extent. The vagaries of the market have surprised many a confident entrepreneur. While doing market research will not give you the equivalent of a crystal ball, it will provide you with a blueprint that can turn your initial concept into a successful company.

How to Conduct Market Research

When you do market research, you deal with two types of data:

- Primary information: This consists of research that you carry out yourself or hire someone to do on your behalf. Examples include in-person interviews, online questionnaires or surveys, and focus groups.

- Secondary Information: The research already exists, and all you have to do is interpret it. Examples include studies and reports by industry associations and government agencies.

Let’s take a closer look at how you collect both.

Primary Research

The goal of doing primary research is to understand current sales trends and customer buying practices in your chosen industry. It can also give you insights into what makes the competition so good at what they do, so you can do it even better.

Primary research methods include:

- Interviews: You can do interviews in person or over the phone. While they can take a little more time to set up and carry out, the information you could get is priceless. You can tailor additional questions to their responses and have a deeper understanding of what your target market wants and needs.

- Surveys: With surveys, the goal is to gather and analyze used statistical data, so the questions are generally closed-ended instead of free form. (e.g. Do you prefer Crave or Netflix? Do you like to shop local or buy online?) While surveys can be done online or by mail, you’ll get a quicker response if you use online tools like SurveyMonkey or Google Forms, and you’ll save on printing and mailing costs.

- Questionnaires: These are different from surveys in that they contain a series of questions aimed at collecting information to provide a bigger picture. Examples include ‘What factors do you consider when buying a new smartphone?’ or ‘What is an appropriate price for a productivity app?’

- Focus Groups: Focus groups are small groups of people who represent your target market. By asking them questions and running ideas by them, you will have a better understanding of how your business will be received by a wider audience. Like interviews, they require more time and effort to set up and manage, but it can be worth it.

When doing primary research, don’t limit yourself to people you know, such as friends, family, and colleagues, as they could filter their responses to avoid discouraging you. To get accurate and actionable information, communicate with real potential customers. You can find them on social media groups and other forums catering to fans of your industry.

Secondary Research

With secondary research, you analyze published data in order to broaden your target scope, identify competitors, and create benchmarks for success. This data is assembled by industry and trade associations, government agencies, chambers of commerce, and other organized bodies and is published in trade publications, newsletters, pamphlets, newspapers, and magazines.

- Commercial sources: If you’re studying the competition, use commercial sources such as the Risk Management Association, Dun & Bradstreet, or research and trade associations. Some organizations publish their data online while others want you to subscribe or join their association first.

- Public information sources: You can find a lot of valuable public data if you know where to look. Check out government statistics like the S. Industry and Trade Outlook, which forecasts emerging trends and provides financial information about U.S. manufacturers, or contact the business development department of your local chamber of commerce.

What to Do with All That Information

You’ve done all that market research. Now what?

It’s time to dig in and see what it tells you. What are your ideal customers saying that they want, need, and absolutely hate? How many people have an unmet need that your business can supply? What does the competition appear to be doing right and how can you do it better?

If you can’t answer any of these questions after reviewing everything, dig further. No business will succeed unless it understands its customers and how its products and services can deliver value to them. Market intelligence is also critical, especially in industries where competition is fierce and every advantage helps. So, get ready to do some homework if necessary and don’t be satisfied with anything less than an A+.

How to Write the Perfect Business Plan

When Benjamin Franklin wrote, “If you fail to plan, you are planning to fail,” he probably wasn’t talking about running a business, but the warning still holds true.

A business plan is a written document that details how your new business is going to achieve its goals from an operational, financial, and marketing perspective. If you’ve only been guided by instinct, inspiration, or even impulse until now, it’s time to give your plan some structure.

In this section of the guide, we’ll tell you why and show you how.

Why do you need a business plan?

A business plan is more than just a roadmap showing you how to get from Point A to Point B as quickly and with as little risk as possible. You also need one for reasons like the following:

- It’s essential if you’re looking for financing. If you’re going to approach a bank, angel investor, or rich but wary relative for startup capital, you need to be able to show them that there’s a market for what you’re selling and what you plan to do to be successful.

- It can help you grow faster. One study found that companies that plan their futures and review their progress regularly can grow up to 30% faster than those that take a more freestyle approach.

- You are more likely to achieve your goals. When your goals are in written form, they become tangible. That makes them easier to assess, evaluate, and modify if necessary. The result is a combination business / action plan that makes sense.

- You minimize risk. There’s always a degree of uncertainty involved when you start a business. Creating a business plan and reviewing it on a regular basis will help you identify any errors or assumptions you’ve made and create contingency plans.

Now that we’ve got you convinced, let’s show you how to write the perfect business plan that can get you financed, support your growth, and reduce risk as you achieve one goal after the next.

Writing your business plan

No two business plans are exactly alike, but there are key elements that are common to most of them. At the very minimum, you should include the sections summarized below.

Executive summary

This section is the Cole’s Notes of your business plan. It summarizes the contents in a way that’s short, sweet, and attention-grabbing. Since business plans aren’t exactly page-turners, anyone reading yours could miss important information if you bury it deep within the document. Be sure to include:

- A company overview

- Your elevator pitch, which tells the reader what your business is, who its customers are, how you intend to run it, and what makes you stand out from the competition.

Industry analysis

Before you start asking anyone to fund your business, you need to know your industry inside and out and be able to present a market overview (e.g., trends, current revenues, and evidence of growth) as well as a detailed outline of your target customers and their needs.

Competitor analysis

In this section, identify your direct competitors, which are the enterprises that offer the same or similar products or services, and indirect competitors, which serve your target market even if they have a different business model. (For example, if you’re opening an organic-only grocery store, you could include major grocery chains that have an organics section.) Be sure to list your competitive advantages and how you plan to capitalize on them.

Operating plan

Summarize your key operational processes, such as product development and testing, manufacturing, sales, and customer service. Include projected milestones, such as $20,000 in revenue per month by the end of 2020 or a trained sales team in place within three months.

Management team

In the beginning, this might only be you, but if you’re running a partnership and/or have already assembled a team, this is where you explain who they are, their roles, and how they can take the company forward. For example, your brother Bob is an experienced app developer who recently left a successful position to help you develop your software business.

Marketing plan

List all of your goods and services in detail and specify how you intend to promote and sell them. This includes:

- Explaining your promotions plans for all the channels you intend to use, such as social media, YouTube videos, blogging, and influencer marketing. Also, don’t forget about your offline marketing techniques, such as print media and business cards. Be as detailed as possible so that investors know that you have a solid strategy in place.

- Laying out your distribution plan. Will you be selling online, in-store, or through strategic partnerships?

Financials

Now we’re talking money! Even if the bank skipped over your product descriptions and team bios, they’re going to scrutinize this section. Guaranteed. You’ll need to explain the following in detail:

- Your business revenue model. How do you intend to make money? What revenue streams will you be using and how do they work?

- How much money you need and how you will use it.

- Financial information about the company, such as startup costs, projected revenues, and estimated growth.

This is where you convince lenders and investors that you plan to put their money to good use and have a well-developed plan for scaling the business and its revenue.

Appendix

If your research has uncovered any relevant facts or figures that don’t belong in any of the preceding categories, add them here. If you’re going to be opening a storefront, information about zoning, leasing, and permits can go in this section.

This can include any information related to permits and leases etc. and any research you want to attach.

Now you’re a doer.

When you’ve got the discipline to sit down and write out the perfect business plan, you’ve made the jump from Dreamer to Doer, and in the business world, that’s everything. Like the name suggests, doers get things done. They plan for everything except failure, so if you’re ready to take that step, kudos! Ben Franklin would be proud.

Pick Your Business Location

Location, location, location.

Some say that British real estate tycoon Harold Samuel coined that saying. Others insist that it first appeared in a 1956 California newspaper ad. (People will argue about anything!)

It doesn’t matter who said it first. The point rings true today—when you’re choosing a place to do business, location matters.

In this section of our Ultimate Guide, we’ll talk about how to pick a location for your business, whether you intend to set up on Main Street or online. Since the former existed long before the latter, we’ll start with things you should consider for a brick-and-mortar location.

Bonus: don’t forget to claim your Google My Business listing right after. It’s free. We’d also recommend making use of a local seo expert to begin to dominate your local 3-pack.

Picking a Storefront

What kind of business are you? Let’s start with that one because it’s the most significant consideration when you’re looking for a location. For example:

- Retail businesses need to be near their customers and, ideally, within walking distance of public transit. A workshop in the woods won’t cut it.

- If your goal is to be shipping products in volume, you need access to major transportation links.

- Tech companies should be set up in areas where a talent tool is readily available once you’re in a position to expand.

Once you’ve identified any special requirements your business has now, or is likely to have in the future, it’s time to search in areas that meet your general criteria. When you find a few locations that look as if they might do the trick, it’s time to dive deeper into their suitability.

Operating Costs

Cash really is king. Your cash flow will dictate whether or not your business survives, so it’s critical to take a close look at average business operating costs for your preferred areas. These include:

- Rent

- Taxes

- Utility costs

- Parking fees (if applicable)

To avoid committing to a location that may be beyond your means when you’re starting out, total all anticipated operating costs and see if the result is something you can currently afford, given other projected expenses like goods and payroll.

Zoning Rules

You’ve found the perfect location—but are you legally allowed to conduct business there? This is where you need to look into local zoning laws and ordinances, especially if you intend to make changes to the property you use or build an entirely new one.

In general, properties are zoned either for residential or commercial use. This rule prevents businesses from being set up in residential areas, and vice-versa. Zoning ordinances can also dictate the following:

- What changes you can and cannot make to an existing structure

- How you can use the property

- Maximum size or height of new construction

If you find a location that appeals to you, contact the city planning agency or seek advice from a business lawyer.

Accessibility

If you expect to be sending and/or receiving regular deliveries, stick to properties located along main roads, and regularly-serviced delivery routes. Access is also a pivotal factor when you’re running a clothing store, coffee shop, or other business that relies heavily on customer foot traffic.

While you’ll pay more for real estate in highly-commercial areas, ensuring that your customers, employees, and vendors can easily access the property is a more pressing consideration.

Competition

Your success can be affected by how close you are to competing businesses. If you’re running a bookstore, for example, and there’s another one down the street from your prospective storefront, it’s probably not a good idea to sign the lease unless you specialize (e.g., only children’s books or PC/tech books) or there’s something you offer that makes you stand out from the other place, like a built-in coffee bar.

Talent Pool

What skill levels will you need your future employees to have? If you’re opening a grocery store, proximity to a family neighbourhood can attract not only customers but teenagers looking for after-school cashier jobs. On the other hand, if you need employees with a specialized skill set, such as graphic designers or software programmers, setting up as close as possible to where they live can make them more amenable to job offers.

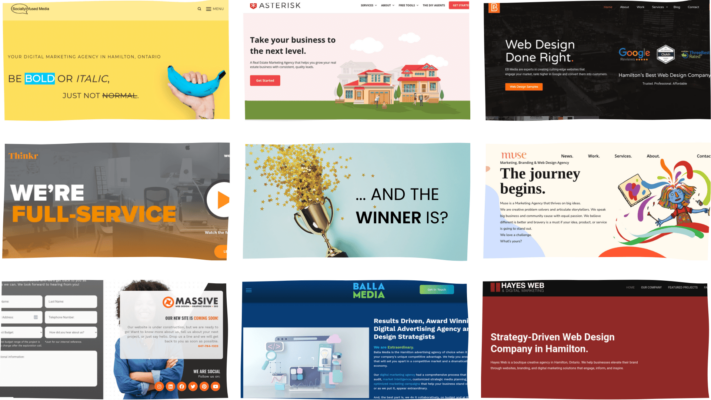

Picking a Digital Storefront

There’s more to setting up an online business than choosing a catchy domain name (although that’s important too). Choosing the right web hosting package is arguably just as important as scoring a prime address for a physical storefront.

This is where you’ll be diving into more homework than your teachers used to throw at you. There are literally thousands of business hosting companies out there, and it’s essential that you select one that’s both reputable AND offers scalable service to support business growth.

At the very least, you’ll need the following:

- Unlimited storage (just to be on the safe side)

- Multiple email address

- Unlimited file transfer

Tip: A free domain would be nice too!

Below are some tips for helping you choose the right web host.

Hosting Package Type

Shared servers are the most affordable option and can be sufficient for businesses that sell smaller downloads, like eBooks and apps. On the other hand, if you intend to make extensive use of video advertising, do any live streaming, or let customers upload any content, you’ll probably be better off with a dedicated server.

Customer Support

Your business site is your livelihood. If it goes down suddenly, you’ll regret signing up with a host that only offers email support between 9:00 a.m. and 5:00 p.m. Make sure that the web host you go with has a wide range of contact options, including phone support, and that it offers 24-7 support for emergencies.

Security

Confirm that the provider offers Secure Sockets Layer (SSL) certificates to protect customer information. Google Chrome requires SSL from a trusted organization in order to indicate that your site is safe to browse, and those ‘This Site Is Not Secure’ messages are REALLY bad PR.

Backups

Websites crash all the time. Ask the web hosts on your shortlist how often they back up client data and what methods they use. You should also put together your own backup plan, but it’s important to find out what business interruption support the host offers.

Read the Reviews

No hosting company will come across as less than perfect on their website. Reading customer reviews on TechRadar, PC Mag, and even the Better Business Bureau will give you a decent idea of each host’s product and service qualities. Just make sure you aren’t influenced by reviewers who clearly have an ax to grind.

Settling Into Your Business Location

It doesn’t matter if your address has a PO Box or domain name: making the right location decision involves a broad and sometimes complex range of issues. If you know what you want, do your research, and keep an open mind, you’re likely to make a decision that Harold Samuel would approve of.

Choose a Business Structure

When choosing a structure for your business, it’s not as simple as eenie, meenie, miney, mo- corporation!

While you certainly could do it that way, you’re playing Russian Roulette with the future of the company. Deciding on a business entity requires a thorough understanding of the different options as well as their advantages, disadvantages, and responsibilities.

To get you started, we’re presenting a list of the most common business structures and their requirements in this article. With a little consideration, you’re sure to identify one that represents the best profit and growth opportunities.

Sole Proprietorship

This is the simplest business structure, which is why it’s the most common. If you want to run a business from your home, a sole proprietorship will let you retain complete control. You keep all the profits- but you’re also responsible for all the debts because you and the business are legally the same, so hold off on that Aresline Xten office chair until you really can afford it.

Advantages of being a sole proprietor include:

- Easy to set up. In many places, you don’t even have to register the business if you’re operating under your own name. If you give it a name, you’ll need to register it (in New York, for example, you file a certificate of fictitious business name), but costs are minimal.

- Handy tax deductions. If you have a home office or use your car for work, you can write off a portion of your home and automobile costs.

- Affordable operation. Depending on where you live, the only fees you may need to be concerned with are business taxes and licensing fees.

Partnership

Does your brother want to use your techy brain to boost his software business idea? Is your mom’s cooking so amazing that you two should run a restaurant together?

If your business has at least two owners, you may want to look at forming a partnership. There are two types:

- General partnerships, in which all owners participate in running the business.

- Limited partnerships, where at least one general partner controls operations and the other (limited) partners invest in the business and share in the profits. While the general partners are responsible for the business’s debt, limited partners are not.

With both partnership types, everyone must account for the partnership profits and losses on their personal income tax returns.

If you intend to form a partnership, it’s essential that you trust your partners to make sound business decisions. If they screw up, you’re liable for their poor choices and vice-versa. This is likely why Entrepreneur called partnerships ‘the Kiss of Death.’ (We think that’s a little dramatic, but the message is clear: know thy partner well.)

Partnership advantages include:

- (Comparatively) easy to form. While not as simple to establish as a sole proprietorship, partnerships are less complicated than other business structures. You’ll need to register the business if it’s not being operated under your own names, but the fees aren’t expensive and you can avoid an awkward name like ‘Joe Smith, Mary Smith, and John Jones.’

- Access to financing. When a company has more than one owner, you’re more likely to qualify for a business loan, especially if a debt collector has your number on speed dial.

Corporation

Unlike sole proprietorships or partnerships, corporations are legally separate from their owners. They can sell stocks, buy and sell property, and be involved in litigation without you being directly affected (although you’d definitely be involved). There are two primary types:

- C-corporations, which are taxed as separate entities and can have an unlimited amount of investors. This is likely why mega-companies like Amazon and Bank of America file as c-corporations. The main drawback is that they file and pay taxes at the corporate level, and you risk double taxation if you get dividends, which are personal taxable income.

- S-corporations avoid double taxation because they are ‘pass-through’ entities. In other words, no tax is paid at the corporate level: all profits and losses are reported on your personal income tax return.

Advantages of this business structure include:

- Limited liability. You aren’t generally responsible for company debts. If someone sues the company and gets a judgment, it can only be collected from the corporation’s assets, not yours.

- Better access to capital. When your business is incorporated, you can raise capital by selling stocks.

- Perpetual operation. Unlike other business entities, corporations can survive the retirement, death or bankruptcy of any of its owners, so you have a legacy to pass on to your family.

In terms of structure and formalities, corporations can be more complicated to lay out and manage than other business entities. They have directors, officers, and shareholders, each with their own responsibilities. They also have to:

- Issue stock

- Adopt bylaws

- Hold director and shareholder meetings

- File annual reports and pay annual fees

Unless you’ve run a business before, you might find corporations trickier to set up and manage. If this entity makes the most sense for you, though, working with a business formation lawyer can get you over the biggest formation hurdles.

Limited Liability Company (LLC)

A limited liability company (LLC) arguably gives you the best of most worlds. It has all the best characteristics of a sole proprietorship, partnership, or corporation and few of their drawbacks. Tax-wise, all profits and losses flow through the owners and investors and are reported on personal income tax returns.

The biggest advantages to forming an LLC are:

- Limited liability: All members are protected from personal liability for the company’s debts unless it can be proven that anyone ran the business in an illegal or irresponsible manner. Everyone’s potential liability is limited to the amount they invested in the business.

- Fewer formalities: Unlike corporations, LLCs in many states don’t have to make yearly reports, hold annual shareholder meetings, or pay annual state fees. Recordkeeping requirements also tend to be less substantial and complicated.

On the downside, forming an LLC is a little more expensive. Depending on the state you live in, you could pay a filing fee of anywhere from $40 to $500. In some states, like New York, you also have to file a biennial statement with the Department of State. If you’re Canadian, the biggest downside is that you can’t form an LLC in Canada!

Business Structure Wrap-Up

As you can see, there’s more to choosing a business structure than playing a kid’s counting game or spinning the bottle and seeing where it lands. You need to consider the work that goes into setting up each one and assess your comfort levels with their respective taxation and operational responsibilities. That way, you can choose the option that produces the best outcome: a business that thrives.

How to get funding for your business

“How do I come up with the money?”

That has to be the most common question entrepreneurs ask (with the possible exception of “What kind of business should I run?”). Unless you’re a Kardashian, no one’s going to throw money at you just because you have a business idea that might work.

Fortunately for you, it’s been decades since your sole source of funding was the bank. If you don’t have any luck with your bank or credit union, there are several other creative options that could work for you. Some are more geared toward some industries and startup types than others, but if the bank says no, one of them could say yes and voila! You’re in business!

Begin by bootstrapping

Many entrepreneurs fund their first businesses by ‘bootstrapping,’ which means that you collect any personal funds available to you. This includes your savings account, lines of credit, credit cards, and even the change in your sofa cushions.

Bootstrapping should always be your first resort because you don’t have to deal with business-related loans and monthly payments that can increase your financial burden until the company succeeds. But if you don’t have access to sufficient funds or you want to scale the business quickly, your next step should be considering friends and family.

The bank of mom and dad

Asking your parents for a loan can be awkward, but there are ways to do it without giving them the impression that your next step will be moving back into your old bedroom or into the basement.

The first step is to show them your business plan. This document explains in detail what you’re selling and at what prices, and how you propose to make money. Next, make it clear to them whether you’re asking them to loan you funds, make an investment in the business, or even provide a gift to get you started. Parents are usually more willing to help financially if the money will be used to help their children develop a livelihood.

If they can’t help or are unable to loan a sufficient amount, try approaching friends and other family members. It never hurts to ask, and you could put together exactly what you need to get those entrepreneurial wheels rolling!

Crowdfunding

Crowdfunding is an increasingly popular way for startups to raise money. Individuals or organizations can donate to or invest in your business in exchange for a potential reward or opportunity to share in your profits.

Although ‘crowdfunding’ is a modern buzzword, the concept is actually hundreds of years old. In the 1800s, authors would collect lists of subscribers who pledged to buy their books if they wrote them, and war bonds technically crowdfunded national defense during World War I and II.

If you want fund your business launch using money from supporters, your options include:

- Kickstarter: Since its inception in 2009, Kickstarter has raised over $4 billion to fund over 155,000 creative and tech projects. Once your campaign is approved, you set financial goals and seek donors. The ‘catch’ is that you only get your funds if you complete your campaign goal.

- Indiegogo: Indiegogo requires you to have a minimum goal of $500. You can choose between fixed funding, which lets you specify the amount you need, and flexible funding, which is a good option when you’re happy with any amount donated. With the latter, you get your money even if you don’t meet your goal.

Micro-loans

If the amount you need to raise is small (typically under $5,000), micro-loan organizations like Accion and Kiva cater to entrepreneurs who are low-income or developing a business aimed at social good. Some, like Western Economic Diversification Canada are regional in scope, so check out what’s available in your state or province.

Go local

If you’re launching a small company, especially one where you envision a storefront, don’t forget to contact your local small business development center. These centers are at most universities and the Small Business Administration has over 60 outlets across the U.S. These locations can help you identify what types of funding or loans you might qualify for. While you’re at it, check out your chamber of commerce, which can point you in the right direction for local funding.

Apply for bank loans

If your business is already up and running and you need a loan in order to increase your output and your profits, you may be able to qualify for a traditional bank loan. Some institutions, like Bank of America and TD Bank, have a history of supporting small businesses, so check out their websites for information on loan amounts and eligibility criteria.

Believe in angels

Once your business gains more traction and you need more funding than bootstrapping or crowdfunding can deliver, it may be time to solicit outside investors, and angel investors are a great place to start.

Angel investors are generally successful and well-established business professionals who want to invest in promising businesses. Depending on the type of company you run and how successful you’ve been so far, you could receive anywhere from $10,000 to millions of dollars.

To connect with an angel, you can contract other entrepreneurs in your network and ask for recommendations. These online resources might also help you get funded:

- AngelList: This popular website connects small business owners and entrepreneurs with angels who might be interested in supporting them.

- Angel Capital Association: Founded in 2009, the association features over 250 angel groups consisting of 14,000 investors.

Go fund you

Getting funding can be the most difficult part of launching your business. Whether you’re developing a cool productivity app or opening your neighborhood’s first organic coffee bar, most entrepreneurs -unless your last name really is Kardashian- need some help getting their venture off the ground and running. Once you’ve saved enough, borrowed enough, or met people who believed in you enough to invest their money, you’re ready to start turning your promising vision into a successful reality.